Virtual Claims Handling

Utilize Our "Virtual First" Process for Maximum Claims Handling Efficiency

RENFROE is one of the pioneers of large-scale virtual claims handling, taking care of thousands of our clients' claims 100% virtually in the first months of the COVID pandemic. Since then, we've nearly perfected the process. On average, our adjusters close 25% more low-complexity claims virtually than through traditional methods, and they do so without sacrificing accuracy or attention to detail.While its not practical for every claim to be handled virtually, carriers can significantly reduce cycle times and claims costs by utilizing our "Virtual First" approach.

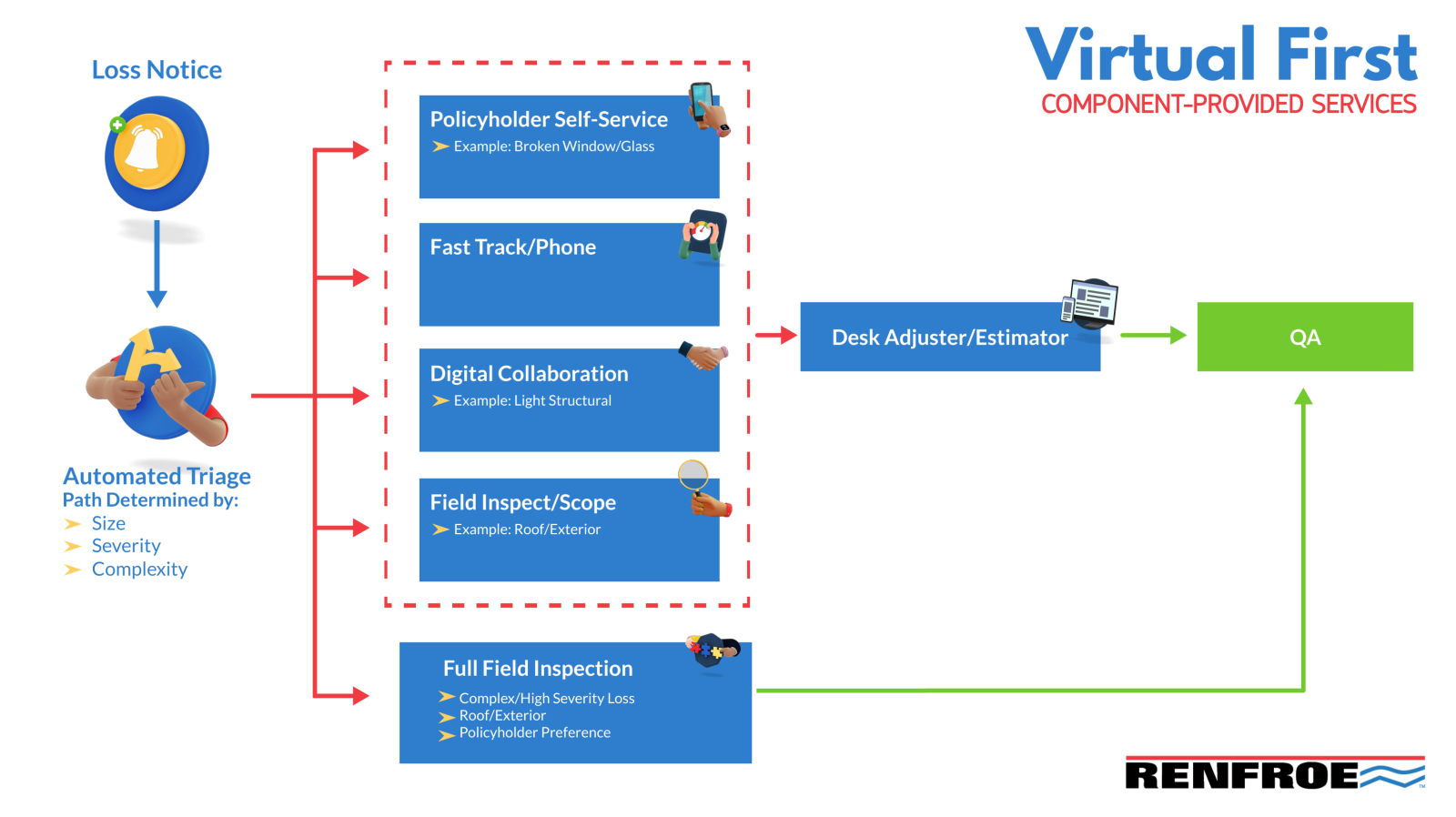

What Does "Virtual First" Mean?

Central to VersaClaim™ is our "Virtual First" philosophy: every claim is a candidate for virtual adjusting until the facts and circumstances rule it out. Many low-complexity claims can be adjusted 100% virtually using self-inspection methods. The policyholder connects remotely with the adjuster at a scheduled time, and using the latest virtual inspection technology, the adjuster guides them through a completely hands-off virtual inspection of the loss, capturing all the important data and pictures from miles away.

For policyholders who may not be comfortable with self-inspection, adjusters can turn to our Inspectors on Demand™ service. We'll dispatch an inspector to the loss and they'll inspect the property and scope the loss. Once they've completed their report and notes, they'll send everything to the adjuster to take over the claim.

What about for more complex claims? While virtual is a great option for the large number of simple everyday claims out there, it's value begins to diminish when the losses are more complex. Whether the complexity is due to extent and severity of damage, or the loss occurred at an exotic or high-value property, the VersaClaim ecosystem and the "Virtual First" approach allow carriers to leverage our other offerings like Estimates on Demand™ and our renowned end-to-end full service Adjusters on Demand™ claims adjuster offering.

Key Advantages

- Resource Management: Our “Virtual First” approach ensures that your most valuable human resources are used only when they’re needed. If a claim can be handled virtually and the policyholder is agreeable to it, it only makes sense, right?

- Customer Experience: We firmly believe that virtual claims handling and good customer service don’t have to be antithetical. In fact, they really can go hand in hand. As the average policyholder age continues to decrease, the average customer is becoming more and more tech-savvy. That means that service expectations are rising: insureds want fewer touchpoints and more transparency in the claims process. Virtual claims handling provides that and much more. But what about those who prefer more traditional processes, even for the least complex of claims? With our Virtual Claims, Personal Service™ guarantee, the human touch is never completely lost, and a live person is always available at any point in the process. Best of all, insureds are never locked into a virtually-handled claim; they can immediately opt-out at any point in the workflow.

- Reduce Expenses: According to LexisNexis, carriers who handle claims virtually see as much as a 50% reduction in loss adjustment expense per claim.

- Shorter Cycle Times: That same LexisNexis study found that carriers handling claims virtually saw cycle times drop from 10-15 days for traditional handling down to just 2-3 days. In 2020, RENFROE conducted a study on claims handling efficiency, where separate adjusters handled identical claims virtually and traditionally. Those who handled claims virtually were able to take on 25% more claims in a given time period than their traditional counterparts, with the same or even greater accuracy.

Make Virtual Claims Part of Your Toolkit

Your policyholders only pay for what they need. Why should you approach claims handling any differently? If a claim can be adjusted quickly and accurately using virtual processes without detriment to the customer experience, why incur the expense of a field inspection? Virtual claims help reduce touchpoints, improve accuracy of low-complexity claims, reduce cycle times, and increase customer satisfaction. If you're ready to make virtual claims part of your toolkit, we've got the process down to a science. Submit your contact information in the form below, and let's talk more about how virtual claims from RENFROE can streamline your claims operations.

Learn more about Virtual Claims - contact us today

Please leave us your contact information below, and we’ll be in touch with you very soon.

"*" indicates required fields